While private label was previously treated by retailers and shoppers as a ‘nice-to-have’, it is now being prioritised by both parties. The question begs asking: Who is driving the growth of private label – shoppers or retailers?

Private label has established its place as a key feature in FMCG retail, driven by retailers and embraced by South African shoppers. According to a recent report, in 2019 private label sales grew +9.6% year-on-year in South Africa, ahead of the +3% growth seen in national brands over the same period. Up to February 2020, private label’s annual sales growth increased to +10.5%.

PRIVATE LABEL PRIORITISED

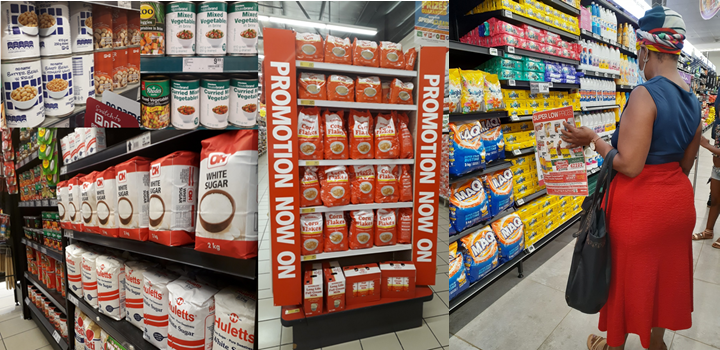

Shopper affinity towards private label started becoming increasingly entrenched during the 2008/2009 financial crisis. While initially private label products were considered of ‘inferior quality’ due to their lower price point, as more and more South Africans were forced to buy them to make ends meet, consumers came to realise that they were of equal and, at times, even superior quality to the number one and number two national brand. Over a decade later, private label is now well and truly established and continues to grow, as South African consumers’ trust in it is secured. In 2020, private label participation reached between 17.1% and 23% within South African FMCG baskets across key retailers, a sure sign of the importance of these cost-effective alternatives in shoppers’ lives. As the demand for private label is growing, many retailers have also started importing more and more cost-competitive products to sell under their private label brands.

With such a positive response from shoppers, more retailers are prioritising private label as a key strategic focus area towards growth. For example, the Shoprite Group positioned “Trusted, profitable private brands” under its strategic focus area of “Closing the gap in key segments”, when it revised its strategy in 2019. The SPAR Group positions private label within its strategy of “Building SPAR brands in the hearts and minds” of its consumers. Since South Africa’s largest FMCG retailers prioritising private label within their strategies, it is likely to see continued growth.

PRIVATE LABEL WITHIN DISRUPTED RETAIL

Over the past year, the COVID-19 pandemic has caused disruptions within the retail landscape and in consumers’ lives. These disruptions have resulted in changes in both shopper behaviour and retailer approaches towards private label products.

The economic impact of the pandemic on consumer disposable income has amplified the key shopper need for ‘value as a necessity’. More shoppers are now switching from their favourite brands to cost-competitive alternatives. In fact, 69% of people are choosing cheaper brands over their favourite brands, according to the Ask Africa COVID-19 Tracker study conducted during August and September 2020.

South African consumers are spending a lot more time at home than before, first triggered by the hard

South African consumers are spending a lot more time at home than before, first triggered by the hard

lockdown and now amplified by the trend where more people are working from home and avoiding public spaces out of safety concerns. As a result, grocery essentials have become a higher priority on shopping lists than luxury goods, a consistent trend observed from the onset of the pandemic, all the way through the festive season and continuing into 2021.

What’s new from a retailer perspective? By the time the COVID-19 pandemic hit, private label was very well established in most retail stores. Being so in tune with shopper needs, retailers

What’s new from a retailer perspective? By the time the COVID-19 pandemic hit, private label was very well established in most retail stores. Being so in tune with shopper needs, retailers

answered the need for value through key price point hampers of grocery staples and commodities such as oil, sugar, flour, maize and rice. These popular hampers, advertised at low prices and featured on the front page of weekly broadsheet adverts, are important drivers of increased basket size in all the major retailers. What has changed is the introduction of private label products within these hampers of branded goods. Retailers are thus responding to the opportunity of promoting their private label products to address the needs of shoppers and secure private label goods in shoppers’ baskets.

WHERE IS THE SHIFT TO PRIVATE LABEL HEADING?

Retailers appear relentless in their focus to promote private label and continue to prioritise range expansion and innovation, highlighting private label’s role as a growth strategy.

The growing reliance of retailers on imported products within their private label offerings can possibly be seen as a weakness, because of the disruptions in global supply chain caused by the likes of a COVID-19 pandemic. This may present an opportunity for South African manufacturers to become preferred suppliers.

At the same time, local manufacturers can take the lead in private label development and innovation, playing to their strengths of understanding the specific needs of South African shoppers.

There is no space for complacency from brand leaders as brand loyalty cannot be guaranteed. Cash-strapped shoppers regrettably are not and often cannot afford to be brand loyal.

Looking at the economic indicators, it is fair to say that South Africans will continue to seek out value for their money over the next few years. For those brands that can jump on board with the supply of private label, the opportunity will continue to grow, especially considering the discounter focus some of the major retailers are embarking on. Brand leaders that need to defend and protect their market share against the growing wave of private label must radically amplify their approach to innovation, differentiation and quality positioning. Consumer engagement is another big consideration, given the incredible levels of engagement that retailers have established with consumers over the past year – indeed becoming lifestyle partners of South African shoppers.

CONCLUSION

The answer to our initial question of who is driving private label is thus two-pronged: as an industry that is shopper-led, every move in FMCG is made in support of shoppers’ needs. So while retailers are driving the growth and evolution of private label and perhaps taking it to levels previously unimagined, they do so because shoppers have no choice but to demand cost-effective alternatives.

Download the PDF HERE