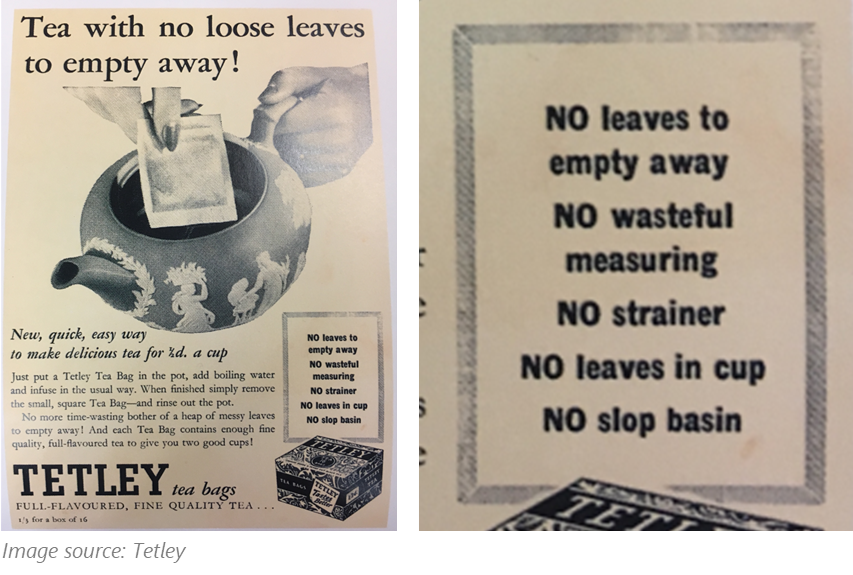

Once upon a time – just over 100 years ago, to be a fraction more accurate – the humble tea bag was the height of convenience. No more messing about with tea leaves that had to be strained from your beverage (or your teeth); now one could simply swish a convenient bag of tea leaves around in your mug (or teapot, if you still wanted to be fancy) and throw it out later. No straining required.

Once upon a time – just over 100 years ago, to be a fraction more accurate – the humble tea bag was the height of convenience. No more messing about with tea leaves that had to be strained from your beverage (or your teeth); now one could simply swish a convenient bag of tea leaves around in your mug (or teapot, if you still wanted to be fancy) and throw it out later. No straining required.

Legend has it that the first tea bags were intended to be single-use amounts of tea opened by users but users took it upon themselves to brew the tea with the tea leaves still enclosed in the porous bags.

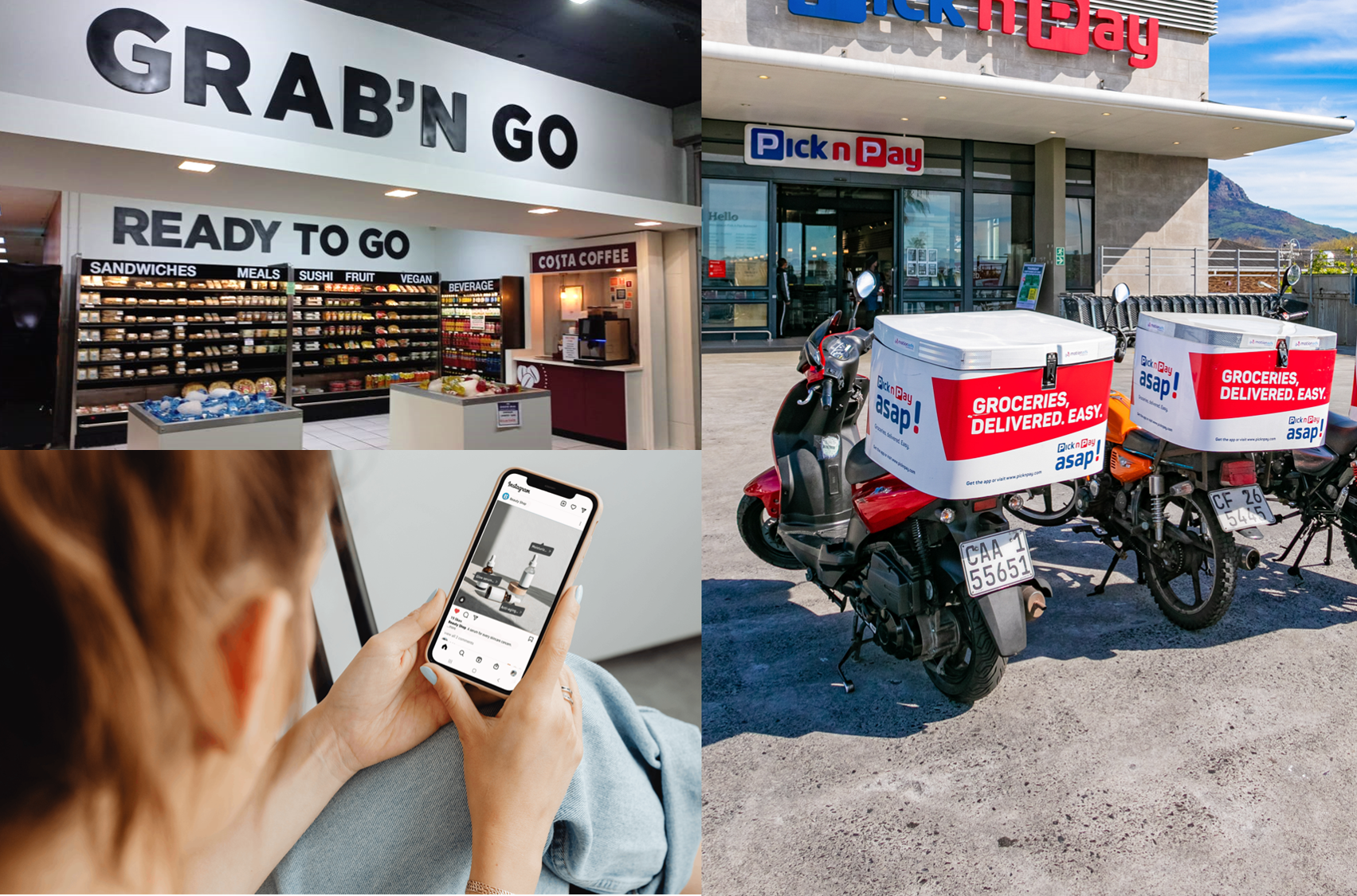

Fast forward to the 2020s and while good tea still requires a few minutes of patient brewing, there is a plethora of convenient options to help us speed up, simplify or ease the pain of the more humdrum day-to-day experiences.

Don’t have time to make coffee before your commute? Grab a cup while your car is filled with petrol!

Can’t make it to the bank or ATM? Get cash from the supermarket till!

Don’t feel like doing the grocery shopping? Have it delivered to your home in the next hour!

Don’t feel like cooking supper? Pop a ready meal in the microwave for 2½ minutes!

Don’t have your wallet with you? Pay at the till with your smartwatch!

Shoppers are increasingly prioritising convenience and retailers are upping their game in response. How big is the opportunity for manufacturers wanting to exploit this trend?

As a retail industry, we love to size things. But can we really size ‘convenience’? At Trade Intelligence, we’ve calculated estimates for the convenience channel, for e-commerce, etc. And we’ve defined the convenience channel as being made up of corporate convenience (KWIKSPAR, Boxer container stores, OK MiniMarts, etc.), forecourt stores (Engen 1Stops, Pick n Pay Express, etc.) and the informal trade. But is this a true reflection of convenience retail?

We put the question to over a thousand online survey respondents. We asked, “Which of these types of stores would you describe as convenient?” and we gave them the option of garage shops, spaza stores, neighbourhood stores, online stores, on-demand apps, and more, fully expecting these formats to be at the top of the ranking. We were very interested to see that while online stores made the top three (in second place), supermarkets placed first, and hypermarkets rounded up the top three most convenient formats.

So clearly convenience is not the sole domain of the traditionally defined convenience channel.

Then there is convenience beyond convenience or even convenient stores. There are convenient ways to pay, convenient store layouts, convenient pack sizes, convenient products (whether it is two-in-one cleaners or meals that are ready in a few minutes in the microwave).

What’s our point?

Convenience is BIG. We can’t even say precisely HOW big. Convenience is BROAD, and therein lies the opportunity.

Manufacturers and retailers need to understand how their shoppers and consumers (current and future) define convenience and cater to them accordingly. For some shoppers, it is bulk packs; for others, it is mini packs. For some shoppers, it is massive one-stop shops; for others, it is small stores with curated ranges.

For retailers, the important lesson is that you do not have to be a convenience store to be a convenient store – there are plenty of convenience boxes to be ticked that do not require being located on a forecourt or only a few square metres big.

For manufacturers, it is about exploring their consumers’ convenience needs, as well as how those translate into convenience shopping needs. There may even be opportunities to partner with retailers in delivering on these needs in a win-win-win for all parties.

The efforts to explore this space in depth and then generate and execute on new opportunities may be (ahem) inconvenient (and perhaps this highlights an opportunity to streamline internal processes? Even employees love a ‘frictionless’ experience) but the rewards are worth it.

The Trade Intelligence Convenience Retail Channel report unpacks the different aspects of convenience in the retail space, identifying opportunities for players in the market along the way. It includes the convenience channel architecture, market size estimates and retail trends.

The Trade Intelligence Convenience Retail Channel report unpacks the different aspects of convenience in the retail space, identifying opportunities for players in the market along the way. It includes the convenience channel architecture, market size estimates and retail trends.

Click here to learn more.

Feel in the form to download the PDF