Consumer interest and adoption of plant-based foods continue to surge, and we’re now at a tipping point where I think it’s safe to say these foods are becoming mainstream. Food Business News recently called plant-based foods the trend of the year, as consumers increasingly incorporate these foods into their diets.

Why has this trend taken such a hold on Americans’ eating habits? Although the percentage of vegetarians and vegans in the U.S. remains at 2.5 percent combined, about one-third of Americans now consider themselves flexitarians and 55 percent said they are trying to add more plant-based food to their diet.

In a recent IRI survey, plant-based dairy consumers who chose to eat plant-based diets said they did so for the following reasons:

- Health and special diet, such as vegan and dairy-free

- The belief that consuming plants is better than consuming dairy products

Of course, while the reasons above are certainly valid for certain consumers, choices may not always be based solely on the facts. When comparing cow’s milk cheese versus plant-based cheese, the calories, fat, sodium and carbohydrates may be higher in many cases versus the plant alternative cheese. Public perception has played a large role in the push for plant-based alternatives, and at least some of the adoption has come down to — like much other business success — good marketing.

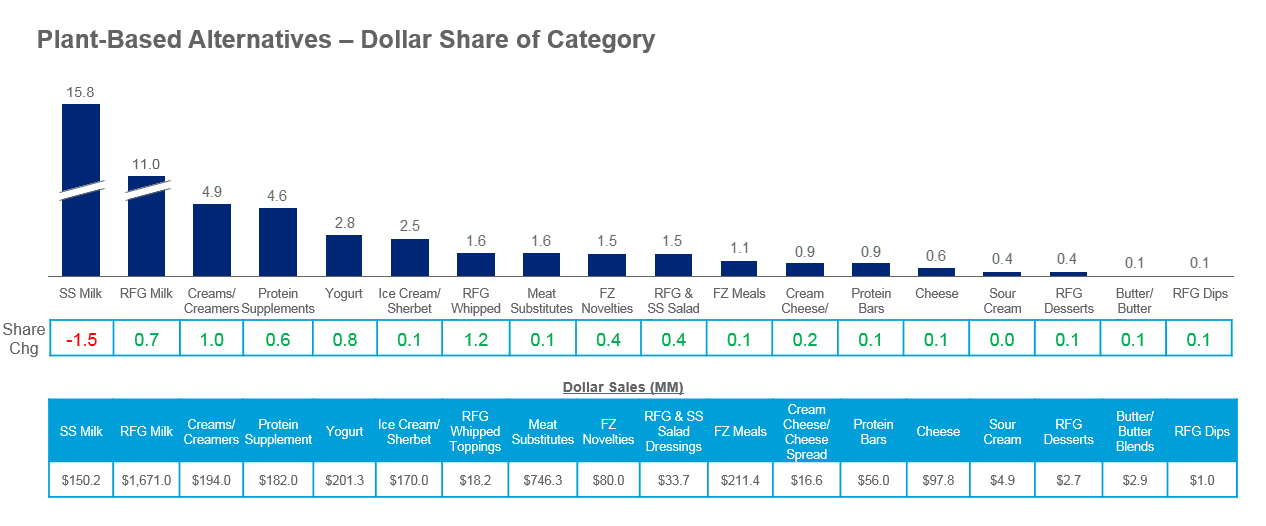

While the leading drivers of plant-based sales continue to be alternatives to meat and dairy specifically, especially cow’s milk substitutes, almost all plant-based segments are gaining share in their categories.

Milk: Refrigerated dairy milk sales have declined by 0.7 percent since 2018, but the loss in volume has not been replaced by the dollar growth of plant-based milk, even as this category has seen an increase of 6.2 percent during the same period. Consumers are choosing almond milk as their top alternative to milk, with channel growth steadily increasing across all outlets except convenience.

Yogurt: Since 2018, dairy yogurt has declined by 1.4 percent while plant-based yogurt has jumped by 36.1 percent. Almond milk yogurts have garnered the majority of sales while oat milk yogurt has seen strong growth in total sales since its introduction last year. Consumers are purchasing plant-based yogurt across all channels; however, distribution remains low in club, drug and convenience channels.

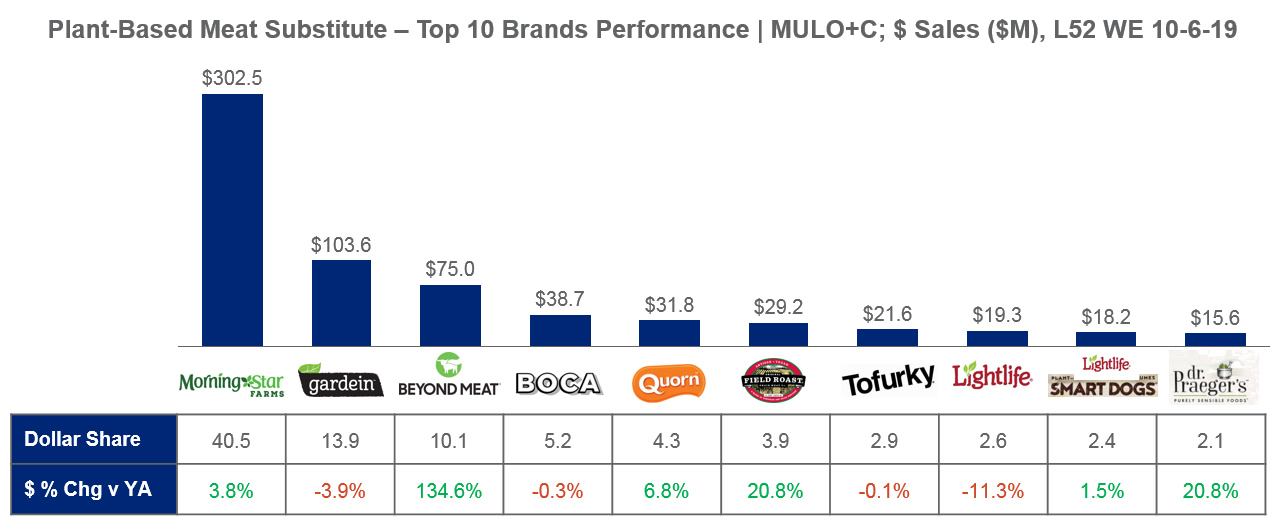

Meat Substitutes: Unlike milk and yogurt, both meat and plant-based substitutes have seen growth rates since 2018 at 2.5 percent and 10 percent, respectively. The industry has developed a new approach to meat alternatives delivering excellent flavor, texture and mouth-feel properties, which are contributing to the large growth in the meat alternatives market. The top distribution channels for meat substitutes are food and mass while club, convenience and drug are declining. Morningstar is still the top-selling plant-based meat substitute, due at least in part to its strong distribution, but Beyond Meat is seeing the strongest growth as it works to increase distribution across most channels.

Ice Cream: Total dairy ice cream and sherbet sales decreased by 1.3 percent while plant-based alternatives have grown marginally by 0.8 percent since 2018. The marginal growth rate has slowed in the last 52 weeks, as the category saw a three-year CAGR of 46.6 percent after 2015. Consumers’ top choices consist of almond and coconut-based alternatives. Top distribution channels for plant-based ice cream include multi-outlet, convenience and food while mass saw declines.

What’s Next for Plant-Based Foods?

The demand for and the array of plant-based sources will continue to grow, and plant-based foods have begun including chickpeas, macadamia, quinoa, rapeseed, algae, chia and hemp, to name a few. The latest consumer craze is around oat with several high-profile launches in the past few years including oat milk, oat creamer, oat yogurt and oat ice cream.

While consumers continue to seek non-animal-based food products — for any or all of the reasons stated above — major CPG retailers are already pledging to increase plant-based product assortments and provide more alternatives for consumers, and many are making it easier for consumers to find these options once they are in the store (for example, Beyond Meat is in the meat aisle in some grocers now). As there are more consumer demands for sustainability, especially as Gen Z spending power grows, the food companies that are transparent and responsible while also offering solutions and convenience will ultimately win.

Want to learn more about how to leverage the plant-based food trend for your business? Watch my recent webinar with FMI on The Surge of Plant-Based Foods, watch my colleague’s webinar with FMI on Understanding the Plant-Based Food Consumer,and/or reach out to me at Tim.Grzebinski@IRIworldwide.com.

https://www.iriworldwide.com/en-US/