Once the hub of social life, South Africa’s malls have become virtual ghost centres during the Covid-19 lockdown.SA is oversupplied with shopping centres, ranking third behind the US and Canada for shopping centre exposure by GDP. During the lockdown only around 15% of shopping centre space was able to trade.

It’s not going to be easy to breathe life back into these former gathering places. We are likely to operate differently after the lockdown; social distancing will continue and unease about public spaces will likely linger, perpetuating the adverse effect on retail spaces.

“Even when the lockdown is lifted people will probably be uncomfortable about visiting public spaces. That’s likely to impact negatively on our retail centres, more so given the oversupply of retail space combined with a lower economic outlook and job losses,” Stanlib’s head of listed property funds, Keillen Ndlovu, tells finweek. “We think the impact will be felt more by the larger regional and super-regional malls. Neighbourhood and community centres are better-positioned.”

Restaurants and entertainment are among those likely to be the most affected and vacancies in the retail space will increase, says Ndlovu. “We’re likely to see rent reductions, concessions or payment holidays, and arrears and bad debt will increase.” Shopping behaviour too has changed and more online shopping, click and collect, and drive-through is anticipated. This doesn’t augur well for the landlords of these spaces, many of them SA’s listed real estate investment trusts (Reits) who, according to Ndlovu, have an exposure of around 56% to malls

Estienne de Klerk, spokesperson for The Property Industry Group, confirms that the sector most affected by the lockdown is retail. The Property Industry Group, comprised of real estate bodies SA REIT, SA Property Owners Association (SAPOA) and the SA Council of Shopping Centres (SACSC), has put in place a relief and assistance package (including rental reductions) for retail tenants affected during the lockdown period. But some retailers are already falling by the wayside.

Struggling retail giant Edcon has already indicated that its Edgars stores may not reopen. Reits are less exposed to Edcon than they were prior to the group’s store rationalisation and closures; down from 2% to around 1% of income for the property sector. Most Reits have been conservative in accounting for Edcon income, some even excluding Edcon numbers in their forecasts as a precautionary measure, says Ndlovu.

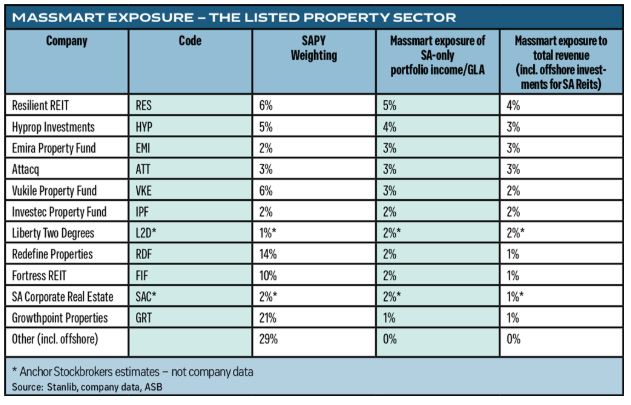

Massmart Holdings is also feeling the pressure.The group, whose brands include Game, Makro, Dion Wired and Builders Warehouse, closed all its Dion Wired stores and there is a concern that it may close or reduce the size of its Game stores. Massmart comprises 1.2% of total income for the listed property sector (see table).

The country’s five big banks have significant exposure to commercial property. According to Nedsec data, the total exposure to SA Reits amounts to R120bn (this excludes exposure through the domestic medium-term note programme). The shock that the pandemic has delivered to trading brings with it risk that some Reits may begin to breach their bank debt covenants. Will banks end up owning these assets?

“Right now, everyone is on the same page, so as long as companies are servicing their interest, I don’t think there’s much risk of that in the short term,” Paul Duncan, portfolio manager at Catalyst Fund Managers Alternative Investments, tells finweek. “Banks will be working with the property companies. They don’t want to take those assets on so I suspect they will relax their covenants.” Most Reits have adequate liquidity to see them through the next six to 12 months to pay their operating overheads and interest bill, even without receiving any rent, he says.

Cash that Reits would normally pay out in the form of dividends will likely be retained to pay operating overheads. De Klerk expects some Reits to cut or suspend dividends for a period – even into next year if they get the thumbs up from the JSE and National Treasury. Reits are obliged to pay out 75% of distributable earnings, maintain rental income of 75% and loan-to-value ratios below 60%. While the JSE has indicated its support for SA Reits, a dispensation for tax relief on the retained income from National Treasury is less of a given.

For investors who rely on dividend income, it’s a tough call. But with revenues impacted and uncertainty around valuations and future income, Reits have been left with little choice if they wish to maintain long-term sustainability.Ndlovu says Stanlib advocates prudence and sticking to Reits with sufficient liquidity and interest cover, loan-to-value ratios and net asset values.

Article Source: https://www.fin24.com/Finweek/Investment/are-the-mall-heydays-over-20200505