Retail pharmaceutical group Dis-Chem Pharmacies yesterday said it had deferred its dividend payment to preserve cash in order to deal with the uncertainties created by the Coronavirus pandemic. African News Agency (ANA)

DURBAN - Retail pharmaceutical group Dis-Chem Pharmacies yesterday said it had deferred its dividend payment to preserve cash in order to deal with the uncertainties created by the Coronavirus pandemic.

Dis-Chem said it was pinning its hopes on the government’s phased reopening of the economy to bounce back from difficulties it experienced since the government announced the Covid-19 lockdown in March.

The group said it would resume the dividend payments once conditions had improved.

“The dividend payment will be deferred until the next dividend cycle once the group better understands normalised trading conditions and considers the funding sources for the Baby City transaction,” the group said.

Last year, the group declared a gross final cash dividend of 13.47cents a share, as it returned R266million to shareholders in dividend payments during the year which was 11.7percent lower than a year earlier.

Recently, Dis-Chem announced that it had entered into an agreement to acquire 100percent of Baby City for R430m from the Aronoff family.

In the year to end March, the group reported a 12percent increase in revenue to R24billion, with retail revenue increasing 11percent to R21.8bn.

Dis-Chem opened 18 new stores and acquired three new pharmacies and grew its portfolio to 170 stores by the end of the year.

Chief executive Ivan Saltzman said the group managed to grow revenue by 12percent, despite a number of challenges and within a constrained economic and consumer environment.

“We continued to focus on our strategy of return on invested capital to ensure optimal returns to shareholders over the long term. This has positively resulted in the necessary inventory reductions and rationalisation across the wholesale space, without compromising sales to customers and has resulted in cash generated from operations increasing by R704m, a 115percent increase compared to last year,” Saltzman said.

The group’s retail revenue grew 11percent to R21.8bn, and wholesale revenue increased 14percent to R16.6bn. It reported a 9.8percent increase in total income to R6.8bn, but earnings per share and headline earnings per share both declined by 16.7percent to 69.6c, as a result of the adoption of IFRS 16 compliance.

Saltzman said the group expected consumer spending to remain constrained with the current deflation in the rand, and the full extent of the impact of Covid-19 still unknown.

In March, Dis-Chem said revenue in its retail stores increased 45.6percent compared with last year, as customers stocked up on products ahead of the lockdown.

The group said the pattern was, however, reversed after the lockdown and that sales decreased 20.9percent.

It said there had been a slight recovery since the easing of the lockdown measures to level 4, with retail revenue increasing by 2.8percent from May 1 to May 16.

“For the 11 weeks to May 16, retail revenue grew by 6.2percent and wholesale revenue grew by 25percent compared to last year,” the group said.

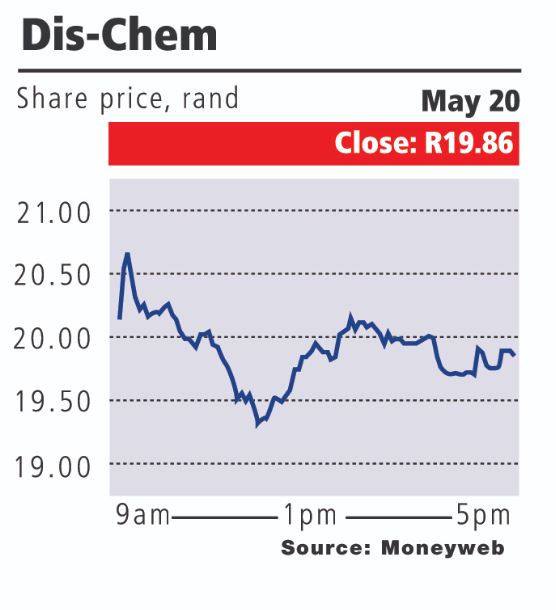

Dis-Chem shares closed1.44percent lower at R19.86 on the JSE yesterday.

Article Source: https://www.iol.co.za/business-report/companies/dis-chem-decides-to-defer-dividend-payment-to-preserve-cash-48293000