The impact of COVID-19 on consumer choices is starting to take shape, and some South African retailers are taking drastic steps to retain market share.

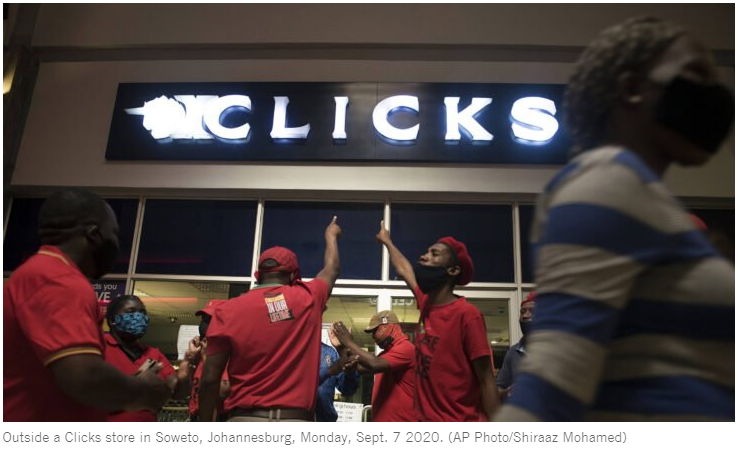

At a time when the world is gripped by the coronavirus, segments of South African consumers stocked up on health and beauty products. This is a noticeable trend from the Clicks Group’s results for the year ended 31 August 2020.

At the food end of retail, Woolworths South Africa is investing R1bn ($61m), most of which will go towards the food business, to address pricing over the next three years. This will see Woolworths South Africa, which caters to more affluent consumers, going toe-to-toe with Pick n Pay.

In its latest update to the market, Pick n Pay acknowledges “customers will require even lower prices and greater value” against the backdrop of COVID-19.

READ MORE South African retailer Pick n Pay banks on discount stores to grow

The Clicks Group Limited is made up of Clicks, the pharmacy, health and beauty retailer; General Nutrition Corporation (GNC), the speciality health and wellness retailer; and The Body Shop, which it manages under a franchise agreement.

There is also Claire’s, a jewellery and accessories retailer the group operates under an exclusive licence agreement; Musica, which focuses on entertainment and gaming; and UPD, its pharmaceutical wholesaler.

In addition to South Africa, the Clicks Group has a presence in Botswana, Eswatini, Lesotho and Namibia.

Clicks and UPD traded throughout South Africa’s national lockdown. However, all Musica, The Body Shop and Claire’s stores were closed.

Location, location, location …

As a result, “pleasing health and beauty sales, and the strong performance of UPD were the main contributors to the group’s diluted headline earnings per share increasing 13.7% to 754 cents,” says the company.

UPD improved 11.2% and gained market share after securing new wholesale and bulk distribution contracts.

The company also noted that: “UPD’s business to the private hospital and independent pharmacy channels grew due to increased demand for medicines and healthcare products during the pandemic.”

- “The accessibility of the Clicks store network proved beneficial, with 74% of stores located in convenience and neighbourhood shopping centres. This negated the slowdown in footfall at super-regional and regional malls across the country.”

- “Online sales in Clicks increased 361% off a low base for the second half of the financial year, reaping the benefit of the investment in its e-commerce and digital platform over the past four years.”

No flu, few sales

However, the absence of a winter cold and flu season – mainly because of social distancing and other COVID-19 safety measures – adversely impacted pharmacy sales, the group said.

READ MORE How Ramaphosa plans to rescue South Africa from economic misery

In period under review:

- Group turnover increased 9.6% to R34.4bn.

- Income grew 8.4% to R9.4bn.

- Retail sales grew 7.3%.

- Distribution turnover increased 11.2%

“The performance of the past year has demonstrated the group’s core health and beauty markets … are resilient.”

When the price is right

Woolworths South Africa CEO Zyda Rylands says the company’s latest move was prompted by the fact that: “We know our customers are under pressure.”

Crucially, “we are investing even more in our prices to ensure we remain relevant and accessible,” adds Rylands in a recent statement.

READ MORE Coronavirus: Woolworths small-shop formats well suited to post-pandemic

Woolworths Holdings Limited encompasses Woolworths South Africa, David Jones and the Country Road Group.

Woolworths Fashion, Beauty and Home; Woolworths Food; and Woolworths Financial Services fall under Woolworths South Africa.

Country Road, Trenery, Mimco, Witchery and Politix make up the Country Road Group.

A total of R750m of Woolworths South Africa’s R1bn commitment will go towards the food business, while the balance of R250m is intended for the fashion business. In the current financial year, Woolworths South Africa will spend R250m on the food business and R250m on fashion, out of the R1bn planned investment.

“Through the crisis, we have focused on identifying efficiencies in our business, as well as in our value chain, to find opportunities to … cut costs. We have worked closely with our suppliers and partners to ensure we realise … sustainable and mutually beneficial operational improvements,” said Rylands.

The long-lasting impact of COVID-19 on economic growth, unemployment and social welfare across southern Africa is also a concern for Pick n Pay.

Pick n Pay has published its interim results for the 26 weeks ended 30 August 2020.

Its core retail sales, including food, groceries and general merchandise, but excluding liquor, clothing and tobacco, grew 8.7%. There was 9.9% growth in South Africa.

READ MORE Some South African brands unlikely to survive COVID warns Havas CEO

Pick n Pay has a presence in Botswana, Eswatini, Namibia, Zambia and Zimbabwe. The group has previously earmarked Nigeria and Ghana for future expansion.

“We remain resolute on our objective to build a simple and more effective business, with sustained cost savings invested back into our customer offer across all the demographics we serve,” according to Pick n Pay.

Article Source: https://www.theafricareport.com/48539/south-africa-the-covid-plan-for-woolworths-clicks-and-pick-n-pay/