The COVID-19 pandemic has led to the emergence of new lifestyle trends and increased economic pressures. Retailers building on the private brand foundations already established over the past few years have responded to these changes through their own products and services, further stimulating growth in their private brands.

Trends such as working from home, less socialising in public places and more eating at home, and an increased focus on health and hygiene have facilitated the launch of new products to meet the needs created. These include, amongst others, ready meals, sanitising products and frozen foods.

The financial challenges resulting from the pandemic as people have downsized or closed businesses, lost jobs, been required to accept reduced salaries and not receive bonuses, have resulted in consumers being forced to consciously seek the best value for their money, a shopper need state that Trade Intelligence terms ‘value as a necessity.’ This has led to an increase in take-up of private brands in South Africa.

Internationally, private brands have been growing steadily over the past decade, while South African consumers have been slower and more reluctant to migrate from proprietary brands (which in many respects symbolise quality and status and are comfortingly familiar) to less trusted and recognisable private brands. Consumers have begun to trust private brands more, however, as retailers have added more premium and lifestyle options.

Internationally, private brands have been growing steadily over the past decade, while South African consumers have been slower and more reluctant to migrate from proprietary brands (which in many respects symbolise quality and status and are comfortingly familiar) to less trusted and recognisable private brands. Consumers have begun to trust private brands more, however, as retailers have added more premium and lifestyle options.

The private brand market has grown as national retail chains have sought to gain market share and increase loyalty through private brands by extending their offerings. At the upper end of the market, brands have represented status symbols in certain categories and there has been little desire or need amongst these consumers to seek cheaper alternatives. A cheaper product is not the only motivating factor, however. In certain categories, such as ready-made meals, private brands may be their first choice.

At the lower end, cash-strapped consumers tended to be brand loyal and less willing to risk spending their constrained incomes on ‘unknown’ brands which may not deliver on their promises. In truth, some of the initial private brand offerings were often of inferior quality, earning these products the reputation of being ‘cheap and nasty’ alternatives to brands – products bought as a last resort. Private brands featured primarily within commodities where consumers tended to be less discerning. However, the improvement in quality and increased relevance in the market of private brands has secured their position as ‘brands’, as opposed to being considered the private ‘labels’ of the past.

The COVID Catalyst

The pandemic created the catalyst required to encourage consumers to trial the new generation, better-quality private brand products.

“The COVID-19 pandemic has resulted in the best dry demo ever as consumers experienced economic constraints which resulted in them being less discerning. Once they trialled private label products and liked them, the price difference was no longer applicable.”

“The COVID-19 pandemic has resulted in the best dry demo ever as consumers experienced economic constraints which resulted in them being less discerning. Once they trialled private label products and liked them, the price difference was no longer applicable.”

Shaun Gatonby, Engage MD

Private brands’ share of total basket value sales increased from 22.8% in 2019 to 23% in May 2020 and rose further to 24.3% by May 2021, which equates to R71bn in annual sales (12 month ending May 2021) [NielsenIQ].

“There’s no doubt that a new generation of private label ‘house’ brands have provided the impetus and created momentum in the local retail sector during one of its toughest times and most difficult trading periods.”

Ged Nooy, NielsenIQ South Africa Managing Director

Currently, an incredible 98% of South African shoppers buy private brands and 64% of South African shoppers purchase private brands every time they shop for food, household, and toiletry products [Daymon Survey 2022]. This behaviour is attributed to an improvement in customer perceptions of private brands over the past two years.

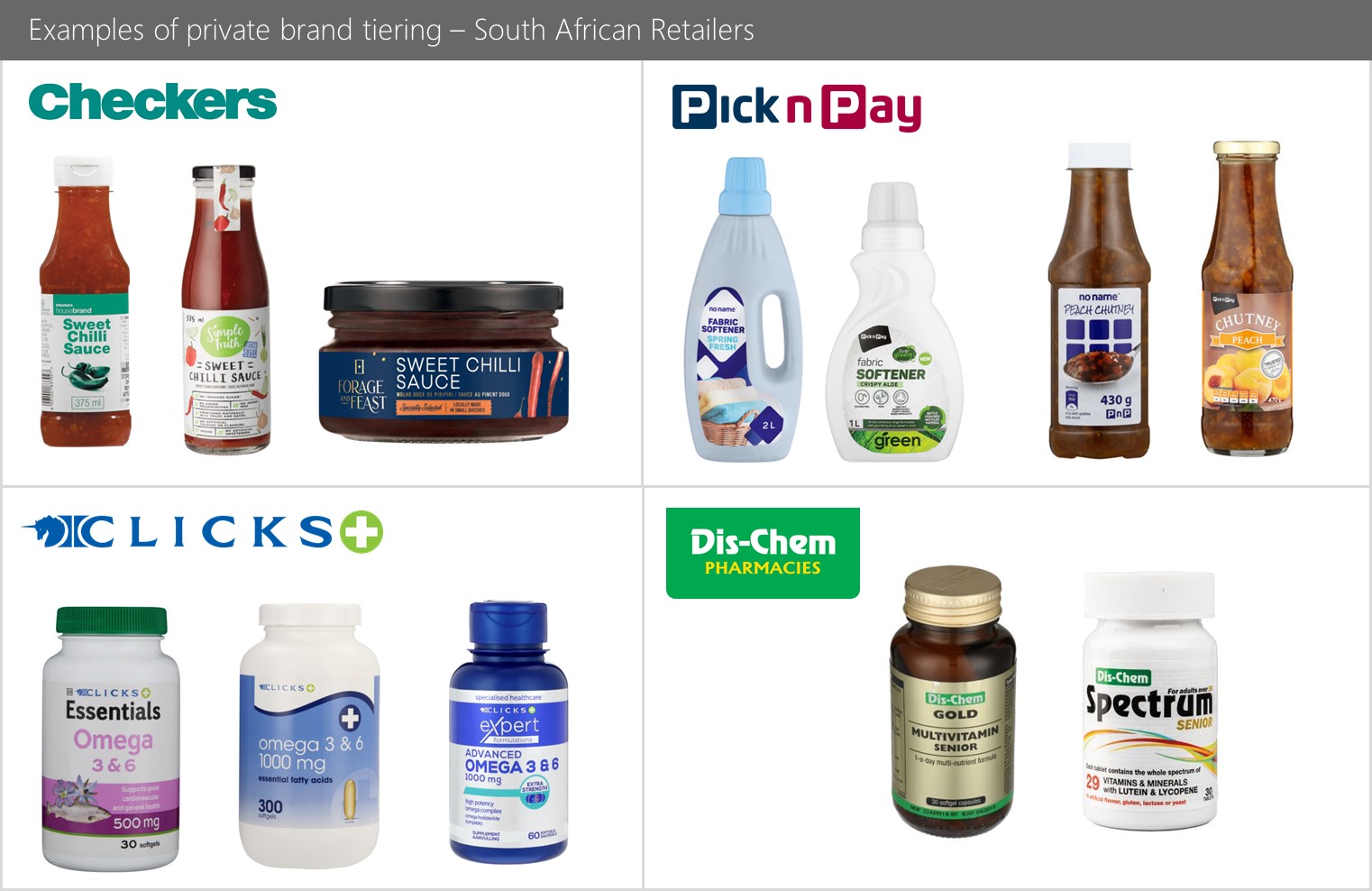

Tiering (within private brands and by using confined labels) has enabled retailers to cater to different markets such as budget, mainstream and premium, offering value to consumers regardless of their income status. Value is no longer a need only of lower-income consumers, but an essential driver to consumer purchases across the income spectrum. Consumers are recognising that private brands are a good way of meeting their need for value. This is supported by statistics revealed in the Daymon 2022 survey where 58% of customers see private brands as better value for money and 62% of shoppers see private brands as being less expensive than national brands.

Private brands are further tapping into consumers’ needs and desires offering products to suit specific:

- Dietary preferences – such as gluten-free or banting, vegan, and vegetarian

- Healthy lifestyles – e.g. reduced fat, no added salt or sugar and sources of fibre

- Bespoke interest groups – such as coffee and/or wine lovers and mothers of babies

- Convenience requirements – e.g. lunchbox snacks, easy-to-prepare foods and smart packaging

- Advocacy beliefs – such as sustainable fishing, saving the planet, recyclable packaging, inter alia

These areas offer opportunities for innovation to private brands as well as suppliers and manufacturers.

Data Informs Strategy

Through loyalty cards, membership groups and online platforms, retailers have ready access to their shoppers’ data, allowing them to examine and understand their customers’ shopping patterns quickly and easily. Using this information, retailers can develop private brand products and packaging customised to their shoppers. Furthermore, retailers have control over private brand marketing and positioning in store, on shelf, across advertising mediums such as broadsheets, as well as digitally via SEOs, presenting their private brands primarily and prominently to online shoppers.

The emphasis on private brands as part of the dominant retailers’ growth strategies is clear with commitment from Checkers and SPAR to satisfy their consumers’ needs through their brands. Emphasis on private brands is evident amongst all the retailers as private brands proliferate.

Traditionally focused on selling national brands, independents are now too seeking a share of the private brand market resulting in the emergence of own brand products being developed to be marketed and promoted via their wholesalers and hybrid (wholesale/retail) outlets. Independents’ private brands tend to fall within the commodity arena, but if retail private brands are anything to go by, this will change over time to include other popular products.

Outlook

The growth in private brands amongst retailers and independents is set to continue unabated, offering opportunities to suppliers, manufacturers, and retailers to innovate, upscale and capture greater market share. Competition is intensifying as stakeholders seek to grow their share of consumers’ baskets.

The winners will be those most in tune with the market and willing to take (educated) risks to bring innovative products to shelves while ticking the boxes of value, quality, availability, and appeal.

The Trade Intelligence Private Brands Report, written in collaboration with Daymon, will provide invaluable insights into shoppers’ needs, market players, strategies being used to leverage market share and opportunities for growth and development of private brands in retail.